Total amount payable = $2,500+$375 = $2,875 Compound InterestĬompound interest is a method where interest received will continue to add up to the principal sum (original sum invested) and the following period’s interest is calculated not only based on the originally invested amount, but based on the addition of principal and the interest earned.Į.g. The interest payable at the end of 3 years will be, an amount of $2,500 is borrowed at a rate of 5% for a period of 3 years. Simple interest can be calculated as per below.Į.g. In simple interest, the funds lent or borrowed will grow depending on the rate of interest and the number of periods involved.

There are two principal ways in which interest is calculated. The interest rate may be calculated monthly, quarterly or annually while annual interests are the most widely used ( Annual Percentage Rate). Interest rate is the percentage charge on saved or borrowed funds. A bank that fails to pass on a cash rate reduces its variable mortgage holders for example, risks losing customers and damaging its public image. Banks don’t actually have to follow the cash rate change when it comes to interest rates, but it’s usually in their best interests to do so. Whenever there’s cash rate rise or fall, the interest rates that banks charge on customer loans will broadly move in line with the change. Cash rate indirectly affects the economy since respective funds are loaned to customers, having a strong relationship with interest rates.

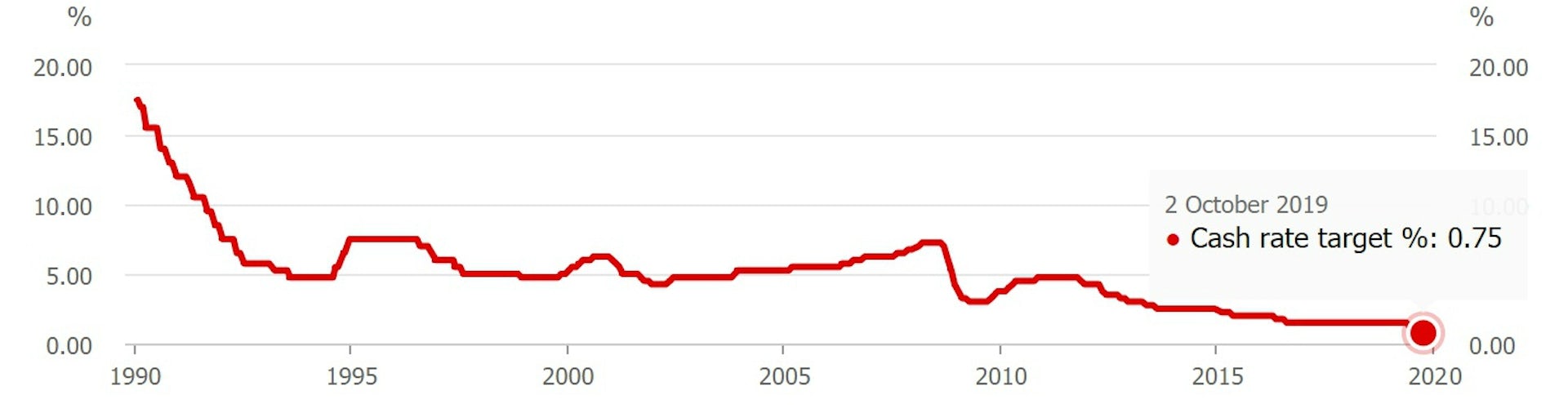

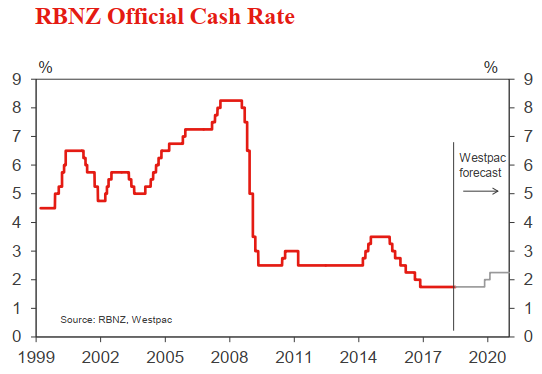

The central bank can increase or decrease the cash rate by a measure of ‘basis points’ in an effort to manage the economy. The term ‘cash rate’ is primarily used in Australia and New Zealand, and has the same meaning as ‘ bank rate’ used in other countries. Side by Side Comparison – Cash Rate vs Interest RateĬash rate, also referred to as the ‘ overnight money market interest rate’, is the rate of interest that commercial banks have to pay on borrowed funds from the central bank. In a broader sense, both these rates are a type of interest rates however, there is a subtle difference between cash rate and interest rate.Ĥ. The key difference between cash rate and interest rate is that cash rate refers to the rate at which commercial banks borrow funds from the central bank whereas interest rate refers to the rate at which a financial charge is received\paid on saved or borrowed funds. Key Difference – Cash Rate vs Interest Rate

0 kommentar(er)

0 kommentar(er)